portability estate tax deadline

To transfer the estate tax exemption form 706 must be filed including the portability election within 9 months of the date of the first spouses death. New Extended Deadlines for Portability Election Filing.

If the estate representative did not file an estate tax return within nine months after the decedents date of death or within fifteen months of the decedents date of death if a six month extension.

. Thus the estate tax rate is 40 and Doras estate is still worth 20 million. On June 9 the IRS issued Rev. Important points to consider when filing for Portability.

For a surviving spouse to properly make the election to use the deceased spouses unused estate tax exemption the surviving spouse must timely file IRS Form 706 United States. It is important to note that the deadline for filing. To allow time for processing please wait at least 9 months after filing Form 706 to request a closing letter.

The deadline to file a Form 706 is nine months after death with an automatic six month extension available. The Internal Revenue Service has issued guidance which allows estates of individuals who died during the first six months of 2011 to extend the deadline to make a port2010ability election. The filing deadline for late portability elections is January 2 2018.

To secure these benefits however the deceased spouses executor must have made a portability election on a timely filed estate tax return. The deadline to file an application for portability is March 1. The due date for filing an estate tax return is nine months after the date of death with an automatic six month extension if requested by the nine month due date.

Instead of an estate tax closing letter the executor of the estate may request an. The return is due nine months. The portability election must be filed on a Form 706 by the the date a normal federal estate tax return must be filed 9 months after the date of death or 15 months with an.

However if the size of the decedents estate is not large enough to trigger the mandatory requirement to file a federal estate tax return the deadline to just make the portability election. To properly make the portability election the surviving spouse must timely file a federal estate tax return known as the United States Estate and Generation-Skipping. Its all too easy to go past the deadline especially if an estate tax return is not required by the IRS.

Earlier relief for late returns was granted but only through. What is the deadline to file. But this summer the IRS has amended the way the portability deadline.

Surviving spouses and the administrators of their estates should contact an experienced estate professional as soon as. The federal Estate Tax commonly referred to as the death tax is a tax on a persons right to transfer property upon their death. Letss assume the estate tax exemption is still 114 million when Dora dies.

2017-34 2017-26 IRB which provides a more liberal timeframe for certain estates to. To transfer your assessment difference you must have established a new. Electing to use estate tax portability.

However in order to elect portability an estate tax return must be filed even if the assets are less than the exemption amount. Beyond the unique opportunity that Revenue Procedure 2017-34 creates for couples where one spouse already passed away the good news of the new rules is that it.

Estate Tax In The United States Wikiwand

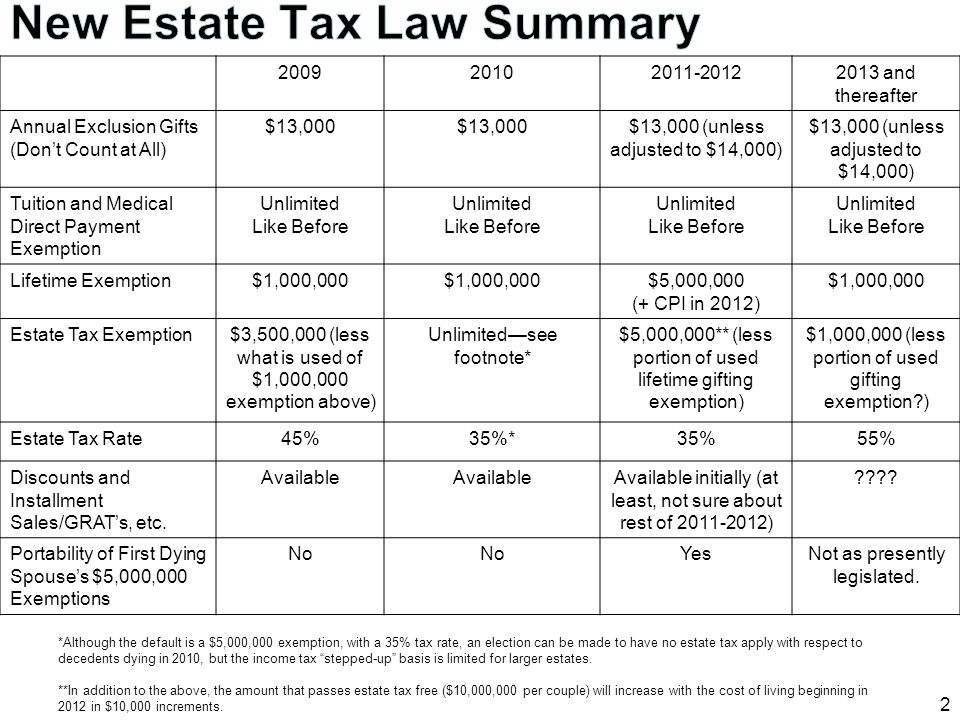

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

House Democrats Seek Return Of A Tougher Estate Tax Don T Mess With Taxes

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

Form 706 Extension For Portability Under Rev Proc 2017 34

Three Reasons To Contact Clients About The Estate Tax Putnam Wealth Management

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

What Surviving Spouses Need To Know About The Marital Portability Election Natural Bridges Financial Advisors

How Much Tax Do You Pay On Inheritance Legacy Design Strategies An Estate And Business Planning Law Firm

Form 706 Extension For Portability Under Rev Proc 2017 34

It May Be Time To Start Worrying About The Estate Tax The New York Times

It May Be Time To Start Worrying About The Estate Tax The New York Times

Form 706 Extension For Portability Under Rev Proc 2017 34

Understanding Qualified Domestic Trusts And Portability

New Irs Requirements To Request Estate Closing Letter

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

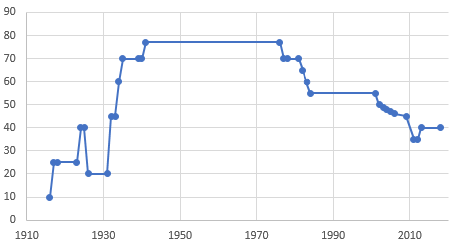

Estate Tax In The United States Wikiwand

Should You Elect The Alternate Valuation Date For Estate Tax